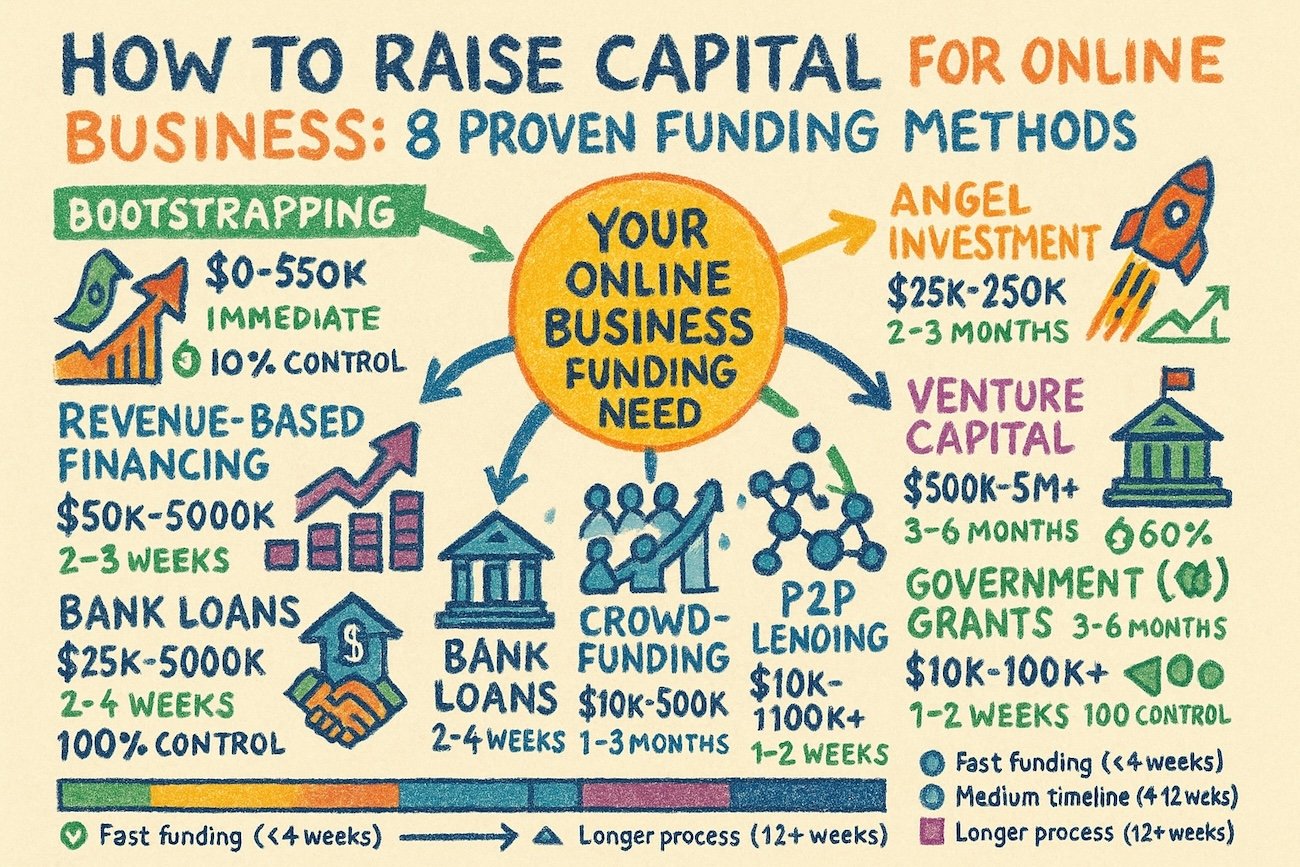

Building an online business is thrilling—until you hit the capital wall. Most entrepreneurs launch with passion and a modest idea, only to discover that scaling requires serious cash. Yet here’s the paradox: 67.5% of potential backers and investors are online and actively seeking opportunities, while global startup funding hit $97 billion in Q3 2025 alone. The question isn’t whether capital exists—it’s whether you know where to find it and how to position yourself to attract it.

This comprehensive guide reveals the eight most effective fundraising strategies for online businesses in 2025, complete with actionable steps, realistic timelines, and insider tactics that separate funded startups from those perpetually struggling for resources.

Why Fundraising Strategy Matters More Than Ever

The fundraising landscape transformed dramatically over the past three years. Traditional gatekeepers (exclusive venture capital firms) now compete with angel networks, alternative lenders, equity crowdfunding platforms, and revenue-based financing models. This democratization created unprecedented opportunities for small business owners and online entrepreneurs who understand where to look and how to position themselves.

Consider the numbers: North America captured 70% of global startup funding in H1 2025, with $145 billion flowing into U.S. and Canadian ventures. Yet this capital concentrated heavily: 33% of all venture funding went to just 16 companies in Q2 2025, most operating in AI. For non-AI startups, alternative funding channels now offer more accessible pathways than traditional VC.

The strategic insight? Your fundraising approach must match your business stage, growth profile, and capital needs. A service-based online business needs entirely different capital strategies than an inventory-based eCommerce store. This guide walks you through each option.

Method 1: Bootstrapping — The Control Champion

Bootstrapping means funding your business through personal savings, revenue reinvestment, and minimal external capital. While it sounds limiting, bootstrapping delivers something venture capital cannot: complete ownership and control.

Mailchimp famously bootstrapped its way to becoming a multi-billion-dollar company by continuously reinvesting profits and maintaining lean operations. This approach works exceptionally well for service-based online businesses, digital products, and software-as-a-service (SaaS) ventures that generate revenue within the first 6-12 months.

Bootstrap Funding Potential: $0–$50,000

Timeline to Access: Immediate

Ownership Retained: 100%

Best For: Service providers, freelancers, digital product creators, bootstrapped SaaS

Bootstrapping Tactics for Maximum Growth:

Start by calculating your absolute minimum viable product (MVP) costs. Most service-based online businesses launch for under $5,000 (domain name, website hosting, basic email marketing tools, accounting software). Focus on revenue generation first—even $2,000 monthly recurring revenue transforms into $24,000 annually available for reinvestment.

Implement aggressive profit-reinvestment discipline. Allocate 60-70% of early profits directly into business growth: customer acquisition, product development, team expansion. This creates compounding growth without diluting ownership.

Use revenue-generating content as your marketing engine. Blog posts, YouTube tutorials, podcasts, and webinars generate organic traffic that converts into customers at minimal cost. This approach delays external funding requirements while building audience authority.

Bootstrap Reality Check: This strategy requires 12-24 months before reaching meaningful scale. If you need $100,000+ within 6 months, bootstrap alone won’t suffice—you’ll need complementary funding.

Method 2: Angel Investment — The Mentorship Accelerator

Angel investors are high-net-worth individuals who invest personal capital into early-stage startups, typically in exchange for equity ownership (usually 10-20% for seed-stage companies). Beyond capital, angels bring invaluable mentorship, industry connections, and strategic guidance.

Angel Investment Potential: $25,000–$250,000 per investor

Timeline to Secure: 2–3 months (with warm introductions)

Ownership Dilution: Typically 10-20%

Best For: Tech startups, SaaS products, mobile apps, validated concepts

Why Angels Invest Differently Than VCs:

Angels are often entrepreneurs themselves. Chris Sacca (who invested in Twitter, Uber, and Instagram), for example, invests based on founder potential and market intuition rather than purely financial metrics. This means angel investors accept higher risk and offer more flexibility than venture capitalists. They’re patient capital—willing to wait 7-10 years for exit events rather than demanding rapid scaling.

Securing Angel Investment: Step-by-Step

Step 1: Build Your Network Foundation

Angels don’t emerge from cold outreach. They invest in founders they know, trust, or were introduced to by trusted advisors. Start attending industry conferences, startup pitch events, and founder communities. Platforms like AngelList (North American focus) and SeedBlink (European strength with 110,000+ vetted investors) provide structured access to angel networks.

Join founder communities specific to your industry. For example, if building a fintech startup, connect with fintech-focused founder groups. These communities share deal flow and provide warm introductions—the holy grail of fundraising.

Step 2: Craft Your Compelling Pitch Deck

Your pitch deck represents your business distilled to 10-15 slides. Include:

- Problem & Solution (slides 1-2): What problem does your business solve?

- Market Size (slide 3): Total addressable market (TAM)

- Business Model (slide 4): How do you make money?

- Traction (slide 5): User growth, revenue, partnerships

- Team (slide 6): Why your team uniquely solves this

- Financials & Projections (slide 7-8): Revenue forecasts, unit economics

- Funding Ask (slide 9): How much capital you need and how you’ll deploy it

Angels invest in founders as much as ideas. Show authentic passion, demonstrate deep market knowledge, and articulate your unfair advantage.

Step 3: Develop Your Warm Introduction Strategy

Direct outreach to angels rarely succeeds. Instead, pursue warm introductions through:

- Accelerator programs (Y Combinator, TechStars, 500 Startups)

- Industry mentors and advisors

- Previous investors in similar spaces

- Founder networks and communities

Each warm introduction increases your success probability dramatically. Target 20-30 warm introductions to secure 2-3 serious angel investors.

Step 4: Position for Multiple Check Sizes

Most angel-funded rounds include 5-10 angels each writing checks of $25,000-$100,000. This syndication approach reduces individual risk while meeting your capital target. Organize around lead angels who commit larger amounts first ($75,000-$100,000), then attract follow-on investors.

Method 3: Venture Capital — The Scaling Jet Fuel

Venture capital (VC) is institutional investment from dedicated funds targeting high-growth businesses with exit potential (acquisition or IPO). VCs write larger checks ($500,000–$5,000,000+) but demand equity stakes (15-40%) and board representation.

VC Funding Potential: $500,000–$5,000,000+ per round

Timeline to Secure: 3–6 months

Ownership Dilution: Significant (15-40% per round)

Best For: Tech startups targeting rapid scale, proven product-market fit, large addressable markets

When VC Makes Sense:

VC is optimal when you’ve achieved product-market fit, generated meaningful traction, and identified a path to $100 million+ market opportunity. VCs aren’t interested in lifestyle businesses or slow-growth ventures—they want companies that can become market leaders within 5-7 years.

VC Investment Process:

Initial meetings focus on founder-investor fit and market potential. VCs evaluate your team’s ability to execute, market timing, and competitive positioning. Successful founders recognize that VC investors are partners in your scaling journey—not merely capital providers.

Due diligence examines financial models, customer contracts, technology architecture, and team backgrounds. This process typically takes 4-8 weeks and demands transparency.

Real 2025 Data: In Q3 2025, capital became increasingly concentrated, with 30% of all VC funding going to rounds exceeding $500 million, predominantly in AI. For non-AI startups, VC funding remains challenging but viable for companies with exceptional traction.

Method 4: Crowdfunding — The Customer Validation Superpower

Crowdfunding allows you to raise capital from hundreds of small investors (the “crowd”) rather than relying on institutional investors. Unlike angel investment, crowdfunding serves dual purposes: funding AND market validation.

Crowdfunding Potential: $10,000–$500,000

Timeline to Complete Campaign: 30–60 days

Ownership Retained: 100% (for rewards-based) or diluted (for equity crowdfunding)

Best For: Product launches, physical goods, services with pre-order appeal

Crowdfunding Models Explained:

Rewards-Based Crowdfunding (Kickstarter, Indiegogo)

Backers receive products or services in exchange for funding—no equity given up. This model works exceptionally well for consumer products, hardware innovations, and creative projects. Successful campaigns generate publicity, validate market demand, and establish early customer communities simultaneously.

Equity Crowdfunding (SeedInvest, Wefunder)

Investors purchase actual company equity, making them shareholders. This model attracts investors seeking financial returns rather than consumer rewards. Equity crowdfunding platforms facilitate regulatory compliance and streamline the investment process.

Royalty-Based Crowdfunding (Royalty Exchange)

Backers receive a percentage of future revenue rather than equity. This hybrid model appeals to businesses wanting external capital without diluting ownership or accepting fixed loan repayments. Investors benefit proportionally as your business grows.

Why Crowdfunding Succeeds for Online Businesses:

Crowdfunding campaigns generate organic marketing momentum. Your campaign landing page becomes a powerful sales tool attracting potential customers, journalists, and early adopters. The campaign itself serves as social proof—”2,000 people backed this idea, so it must be valuable.”

Platforms like Kickstarter have helped startups raise $7+ billion in total backing, with successful campaigns averaging 30-40% higher awareness among target customers compared to traditional marketing.

Crowdfunding Success Factors:

Your campaign video represents your single most important asset. Invest in professional production—campaigns with high-quality videos succeed at 5x higher rates than those with amateur footage. Your video should tell an emotional story, demonstrate the product clearly, and articulate why your solution matters.

Offer tiered reward levels attracting different customer segments. Early-bird pricing ($50-100) attracts committed supporters. Mid-tier options ($150-300) appeal to mainstream buyers. Premium tiers ($500+) capture enthusiasts willing to pay premium prices.

Crowdfunding Reality: While potentially fast capital, success demands significant pre-campaign preparation (3-6 months of positioning) and active campaign management (daily updates, community engagement).

Method 5: Bank Loans & SBA Financing — The Predictable Path

Traditional bank loans remain viable for online businesses with established revenue and solid credit profiles. While regulatory requirements increased post-2008, banks modernized their assessment tools and accelerated approval timelines.

Bank Loan Potential: $25,000–$500,000+

Timeline to Approval: 2–4 weeks (with digitized processes in 2025)

Ownership Retained: 100%

Best For: Service businesses, established eCommerce stores, inventory-based operations

Bank Loan Requirements:

Banks evaluate creditworthiness through: personal credit score (typically 680+), business credit history, personal guarantee, and collateral. In 2025, digital lending through fintech platforms reduced approval friction significantly, with automated underwriting assessing loan applications in days rather than weeks.

SBA Loans (Small Business Administration)

SBA-backed loans offer more favorable terms for small businesses, with government guarantees reducing lender risk. Common SBA programs include 7(a) loans ($350,000 average) and microloans ($50,000 average), targeting underserved entrepreneurs and minority-owned businesses.

Why Online Businesses Struggle with Bank Loans:

Banks traditionally demanded physical collateral and established business history. Online businesses, especially dropshipping or digital product stores, lack tangible assets to secure loans. However, revenue-based lending and digital assessment tools evolved to address this gap.

Banks now evaluate: monthly recurring revenue, customer acquisition cost, lifetime customer value, and growth trajectory. If your online business generates $5,000+ monthly revenue with predictable growth, bank financing becomes accessible.

Method 6: Revenue-Based Financing — The Growth-Aligned Option

Revenue-based financing (RBF) emerged as a compelling alternative to traditional debt and equity. Instead of fixed monthly payments, you repay a percentage of monthly revenue (typically 3-10%) until reaching a predetermined repayment cap.

RBF Potential: $50,000–$500,000

Timeline to Access: 2–3 weeks

Ownership Retained: 100%

Best For: SaaS, subscription services, recurring revenue models

Why RBF Exploded in Popularity:

RBF eliminates the traditional debt burden paradox: early-stage businesses can’t afford fixed monthly payments because revenue is volatile. RBF aligns investor returns with your business success—when revenue grows, repayment increases proportionally. When revenue dips, repayment adjusts downward.

Market Growth Demonstrates Investor Confidence:

Revenue-based financing grew 70.9% from 2023-2024, with valuation reaching $5.78 billion. Industry projections forecast RBF reaching $41.8 billion valuation by 2028. This explosive growth reflects investor recognition that RBF suits high-growth, recurring-revenue businesses perfectly.

RBF Ideal Scenario:

Your SaaS platform generates $15,000 monthly recurring revenue and grows 15% monthly. You secure $200,000 RBF at 8% repayment rate. Monthly repayment begins at $1,200 (8% of $15,000). As revenue grows to $30,000, repayment increases to $2,400. This aligns incentives: the investor benefits when your business scales.

RBF Limitations:

RBF works poorly for: non-recurring revenue models, inconsistent cash flows, seasonal businesses, or one-time sales models. Your business needs predictable revenue patterns for RBF to function effectively.

Method 7: Government Grants & Incentive Programs

Government agencies worldwide distribute billions in grants, subsidies, and tax incentives targeting startup innovation, job creation, and economic development. Unlike loans or equity, grants require no repayment.

Grant Potential: $50,000–$1,500,000+

Timeline to Approval: 3–6 months

Ownership Retained: 100%

Best For: Tech innovation, cleantech, biotech, social enterprises

Grant Challenges:

While grants sound ideal, they’re intensely competitive and demand extensive documentation. You’ll typically compete against 500+ applications for funding. Application processes require 40-60 hours of work compiling business plans, financial projections, impact metrics, and regulatory compliance documentation.

Grant Success Strategy:

Focus on government agencies aligned with your industry. Technology companies target National Science Foundation (NSF) Small Business Innovation Research (SBIR) grants. Cleantech startups pursue Department of Energy grants. Social enterprises access foundation grants from established nonprofits.

Build relationships with grant consultants who specialize in your industry. While costing $5,000-$15,000, specialized consultants dramatically improve approval odds—sometimes 3-5x higher success rates.

North American Opportunities:

- NSF SBIR/STTR grants: $50,000–$2,000,000 (tech innovation focus)

- Small Business Administration grants: Sector-specific, typically $50,000–$500,000

- State innovation grants: Varying amounts, often matching private investment

- Economic development authorities: Local grants supporting job creation

Method 8: Peer-to-Peer Lending — The Democratic Finance Approach

Peer-to-peer (P2P) lending connects individual investors with entrepreneurs through online platforms. Unlike banks, P2P lenders evaluate applications through alternative metrics, making them more accessible to early-stage businesses.

P2P Lending Potential: $10,000–$100,000+

Timeline to Funding: 1–2 weeks

Ownership Retained: 100%

Best For: Service businesses, established online stores, creators with consistent income

How P2P Lending Works:

You create a loan request listing your business, funding need, and intended use. Individual investors review applications and commit capital in increments ($25-$1,000 typically). Once the funding target is reached, capital transfers to you.

P2P Lending Advantages:

Approvals happen fast—2-7 days compared to 2-4 weeks for bank loans. Platforms like Prosper and LendingClub evaluate creditworthiness holistically rather than demanding pristine credit scores.

P2P Lending Realities:

Interest rates typically exceed bank loans (8-36% annually) because P2P lending accepts higher-risk borrowers. Monthly payments require cash flow discipline—unlike RBF, payments remain fixed regardless of revenue fluctuations.

The Cost to Start an Online Business: What Actually Happens in 2025

Before pursuing external capital, understand your baseline capital requirements. Online businesses range from $500 for service-based ventures to $60,000+ for complex eCommerce operations.

| Business Type | Typical Cost Range | Key Cost Drivers |

|---|---|---|

| Service-based (freelance, consulting) | $500–$5,000 | Website, software tools, marketing |

| Dropshipping store | $1,000–$5,000 | eCommerce platform, apps, ads |

| Inventory-based eCommerce | $2,000–$10,000+ | Inventory, storage, packaging, shipping |

| Digital products (courses, templates) | $1,000–$7,000 | Hosting, design tools, sales funnels |

| Custom eCommerce site | $10,000–$60,000+ | Design agency, advanced features, paid advertising |

Key Insight: 47% of small business owners with employees started with over $25,000 in capital, demonstrating how quickly expenses accumulate beyond initial estimates.

Your 90-Day Fundraising Roadmap

Starting Weeks 1-2: Assessment & Strategy

- Calculate exact capital needs

- Identify which funding method aligns with your business model

- Assess your current financial position and creditworthiness

Weeks 3-4: Preparation

- Build your pitch deck or executive summary

- Organize financial projections and historical data

- Develop your funding narrative (why you, why now, why this opportunity?)

Weeks 5-8: Outreach & Pitching

- For angel investment: Activate warm introduction network

- For crowdfunding: Launch campaign

- For loans: Submit applications to multiple lenders

- For grants: Submit applications to relevant agencies

Final Weeks 9-12: Follow-Up & Negotiation

- Maintain active communication with potential investors

- Negotiate terms and conditions

- Close funding and deploy capital strategically

The Bottom Line: Your Path to Well-Funded Growth

Successful fundraising combines strategic method selection, authentic founder positioning, and persistent execution. The 2025 fundraising landscape offers unprecedented options for online business owners—from completely equity-free bootstrapping to angel syndicates, crowdfunding validation, and alternative lending solutions.

The critical decision isn’t which method is “best”—it’s which method matches your business stage, growth profile, and capital requirements. A service-based business might bootstrap to $50,000 annual revenue before pursuing angel investment. An inventory-based eCommerce store might combine bank loans and personal savings. A SaaS startup might pursue seed funding through angel syndicates before Series A venture capital.

Your competitive advantage emerges from understanding all options and selecting the optimal combination for your unique circumstances.

Ready to Fuel Your Online Business Growth?

Securing capital is only half the battle—deploying it strategically separates successful scaling from wasteful spending. Whether you need a professional website that converts visitors into customers, SEO optimization that drives organic traffic, or complete digital marketing strategy, the right digital partner amplifies your fundraising impact.

👉 Explore PerfectPixel Digital Agency’s affordable SEO services for small business to maximize your online visibility and prove business traction to potential investors.

👉 Get your free fundraising strategy consultation — Let us build your competitive advantage and discover how our digital services accelerate growth for startup founders and small business owners nationwide.